What Is The Penalty For Filing Single When Married? Your Guide To Tax Status

You know, like your favorite sports brand, Penalty, shows us that some penalties are about playing hard and winning, a bit like a game, so. But then there are those other kinds of penalties, the ones that come from the tax folks, and those are definitely not for fun or sport, are they? It’s a bit like a serious game where the rules really count, you know?

When tax season rolls around, choosing your filing status feels like a really big deal, and it truly is. Many people, perhaps understandably, get a little mixed up about what their options are, especially if they are married. There's a common question that pops up quite a lot: "What is the penalty for filing single when married?" It's a query that shows a real concern about getting things right with the tax authorities, and that's a good thing, as a matter of fact.

This article is here to help clear things up, so you can feel more sure about your tax decisions. We’ll talk about why your filing status is such a big deal, what might happen if you pick the wrong one, and what you can do if you’ve already made a mistake. It’s all about helping you understand the rules better, which is pretty important, actually.

- What Is The Walk Away Husband Syndrome,html

- Does Kate Have An Ostomy,html

- May Seeds Leak A Comprehensive Guide To Understanding And Addressing The Issue,html

- Naomi Soraya Leak The Untold Story Behind The Viral Sensation,html

- Hannah Uwu Nudes The Story Beyond The Viral Buzz,html

Table of Contents

- Why Filing Status Matters So Much

- The "Single" Status: Who It's For

- Married? Your Choices Are Different

- What Happens If You File Single When Married?

- Why Someone Might File Single When Married (And Why It's a Bad Idea)

- What to Do If You've Already Filed Single While Married

- Preventing Future Filing Mistakes

- Frequently Asked Questions (FAQs)

Why Filing Status Matters So Much

Your tax filing status is, quite simply, the very first thing you pick when you get ready to do your taxes. It’s like setting the stage for everything else that follows, you know? This choice is really important because it decides so many things about your tax situation. It helps figure out which tax rates apply to you, what deductions you can take, and what credits might be available to help reduce the money you owe. Basically, it shapes your entire tax bill, so it's a pretty big deal, you know?

Think of it this way: picking the right status is like having the correct key for a very specific lock. If you use the wrong key, things just won't open up right, and you could end up with a lot of problems. For instance, some tax breaks are only for certain statuses, and if you don't pick the right one, you could miss out on money you truly deserve. It's a bit like playing a sport with the wrong equipment; it just doesn't work as well, does it?

The government sets these rules for a reason, to make sure everyone pays their fair share based on their life situation. So, understanding your options and picking the one that truly fits your life is a really important step. It’s not just a small detail on a form; it has real effects on your wallet, and that's something to think about, isn't it?

- Ryan Watts Net Worth,html

- How Do Cheaters Act When Guilty,html

- Who Has The Smallest Fan Base In The Nfl,html

- Onlyfans Leak The Untold Story Of Tooturnttonys Rise And Controversies,html

- Nikki Haley Nude Separating Facts From Fiction And Understanding The Bigger Picture,html

The "Single" Status: Who It's For

The "Single" filing status sounds pretty straightforward, doesn't it? It's for people who aren't married, either because they never have been, or because they are legally divorced or separated by the end of the tax year. That's the key thing: your marital status on December 31st of the tax year is what counts. If you're not hitched by that date, then single is usually your go-to option, more or less.

There are a few other situations where "single" might apply. For example, if your spouse passed away during the tax year, you might still be able to file as single for that year, depending on other things. It's really about your legal standing at a specific point in time, you know? It’s not just about living alone or feeling independent; it’s about what the law says about your marital bond.

It’s very important not to confuse being single for tax purposes with simply living apart from your spouse. The tax rules are quite particular about this. Just because you don't live together doesn't automatically make you "single" in the eyes of the tax folks. You need a legal separation or divorce decree to truly be considered single for tax filing, as a matter of fact.

Married? Your Choices Are Different

If you are married on the last day of the tax year, December 31st, the tax rules offer you two main choices for filing your return. You can pick "Married Filing Jointly" or "Married Filing Separately." These are the options that truly fit your situation when you're legally tied to someone. It’s a bit like picking a path, and each path has its own scenery, you know?

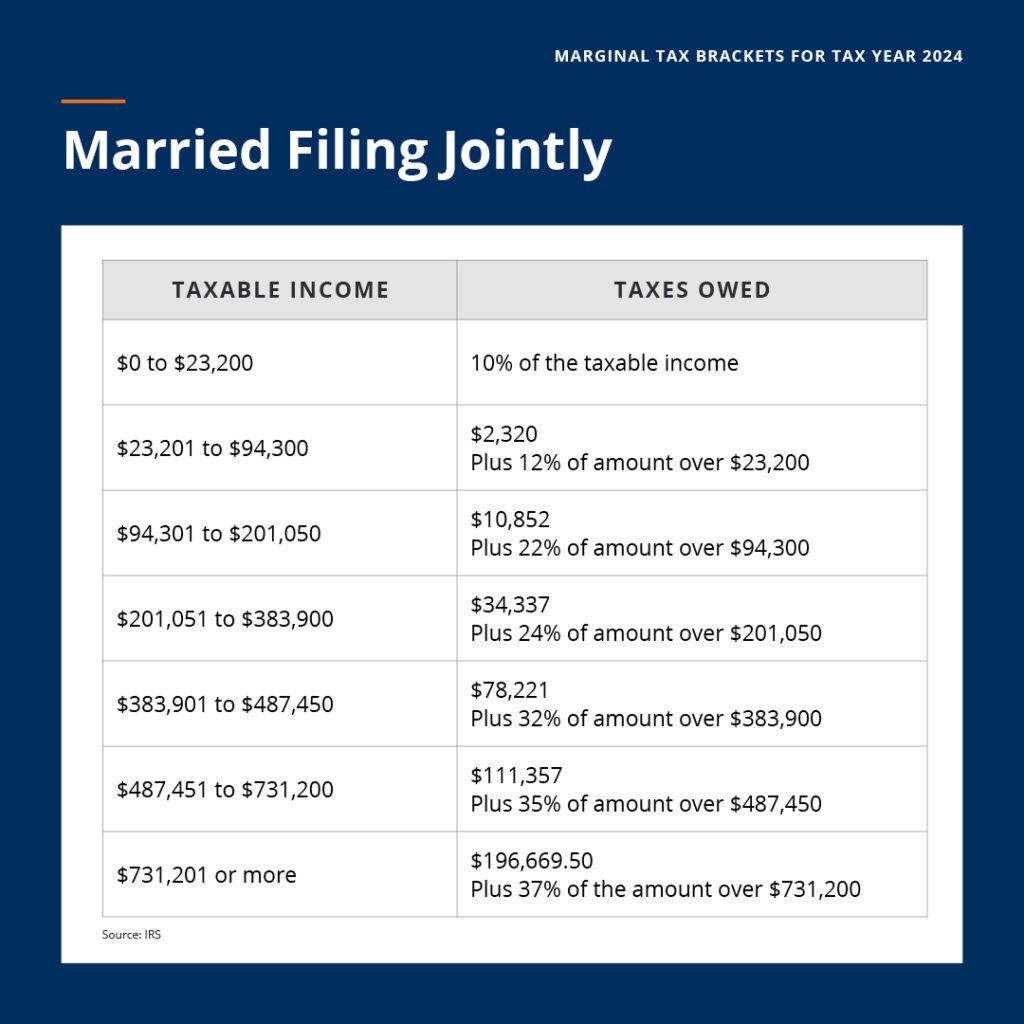

Most married couples choose "Married Filing Jointly." This means you and your spouse combine all your income, deductions, and credits onto one tax return. It often leads to a lower overall tax bill for the couple, and it’s generally simpler to prepare just one return instead of two. It's a very common way to do things, and for many, it just makes the most sense, doesn't it?

The other option is "Married Filing Separately." With this choice, you and your spouse each file your own individual tax return, reporting your own income, deductions, and credits. This can sometimes be useful in very specific situations, perhaps if one spouse has a lot of medical expenses or if there are concerns about one spouse's past tax issues. It’s not usually the choice that saves the most money, but it can offer a kind of financial independence for tax purposes, you know? It's a choice that needs some real thought, anyway.

What Happens If You File Single When Married?

So, what really happens if you're married but you go ahead and file your taxes as "Single"? Well, it's not a simple oversight in the eyes of the tax people, sadly. It can lead to some rather serious consequences, and nobody wants that, do they? It’s a bit like telling a white lie that has bigger repercussions than you might think, you know?

The IRS View: It's a Mismatch

The tax folks, the IRS, have ways of knowing your marital status. When you file your taxes, they match up your Social Security number with information they get from other places, like your employer's W-2 forms or other income statements. If their records show you're married, but your tax return says you're single, that's a big red flag for them, you know? It creates a mismatch, and they are pretty good at spotting those, actually.

They might send you a letter, a notice, saying there's a problem with your filing status. This letter isn't usually a direct accusation, but it's a prompt for you to fix things. It's their way of saying, "Hey, something doesn't look quite right here, could you check it out?" It's a very clear signal that something needs attention, and you really don't want to ignore it, do you?

Ignoring these notices is never a good idea. The IRS expects you to respond and correct any errors. They are pretty serious about getting things right, and they have processes in place to follow up if you don't. So, it's always best to deal with it quickly and directly, as a matter of fact.

Potential Penalties and Consequences

When you file with the wrong status, especially filing single when married, it can lead to a few different types of financial punishments. These aren't just minor slaps on the wrist; they can really add up and cost you extra money. It's a bit like getting a foul in a game that costs you points, you know? And these points are your hard-earned cash.

Accuracy-Related Penalties

One of the most common penalties is the accuracy-related penalty. This can be assessed if the IRS believes you made a mistake that resulted in you paying less tax than you actually owed. This penalty is typically 20% of the underpayment. So, if you should have paid $1,000 more in taxes, that's an extra $200 penalty right there, just for the mistake, you know? It’s a pretty significant chunk of change, actually.

This penalty is designed to encourage people to be very careful and truthful when they prepare their taxes. It's not just for outright fraud; it can apply to simple errors that lead to a lower tax bill than what was due. The IRS wants you to be as precise as possible, and this penalty helps make that point very clear, you know?

Sometimes, if the mistake is very small or if you can show you made an honest effort to get it right, the IRS might waive this penalty. But that's not a guarantee, and it's always better to avoid the situation in the first place. So, getting your filing status correct from the start is truly the best plan, isn't it?

Failure-to-Pay Penalties

If filing as single when married means you ended up owing more tax than you reported, you might also face a failure-to-pay penalty. This penalty is usually 0.5% of the unpaid taxes for each month or part of a month that the taxes remain unpaid. This can keep adding up until it reaches a maximum of 25% of your unpaid taxes. It’s a slow burn, but it can get pretty hot, you know?

This penalty starts from the original due date of the tax return, even if you filed an extension. It's all about making sure the government gets its money on time. If your incorrect filing status led to you underpaying, then this penalty kicks in. It’s a very straightforward rule, and it applies pretty consistently, actually.

The longer you wait to fix the mistake and pay what you owe, the more this penalty will grow. That's why acting quickly once you realize there's an issue is really important. It can save you a good bit of money in the long run, you know? It’s just common sense to address it quickly, isn't it?

Interest Charges

On top of any penalties, the IRS will also charge interest on any unpaid taxes. This interest starts building up from the original due date of the return until the date you actually pay the full amount. The interest rate can change each quarter, but it’s usually based on the federal short-term rate plus 3 percentage points. It’s like a meter running on your unpaid taxes, you know?

Interest is charged even if you didn't mean to underpay your taxes or if you were just confused about the rules. It's not a penalty for wrongdoing, but rather a charge for the use of money that was owed to the government. So, even if you fix the filing status, you'll still owe interest on the difference from the original due date, as a matter of fact.

These interest charges can really add up over time, especially if the amount of unpaid tax is significant or if it takes a while to resolve the issue. It's another reason why getting your tax return right the first time, or fixing it quickly if it's wrong, is so important. You want to avoid those extra costs, don't you?

Losing Out on Tax Breaks

Perhaps one of the biggest hidden costs of filing single when married is missing out on valuable tax breaks. Many deductions and credits are either unavailable or significantly reduced if you file as single while married, compared to filing jointly or even separately. It’s a bit like leaving money on the table without even realizing it, you know?

For example, married couples filing jointly

Detail Author:

- Name : Gerda Miller DVM

- Username : sullrich

- Email : delphia89@toy.net

- Birthdate : 1977-04-29

- Address : 1829 Haley Streets Suite 711 Delilahville, UT 75680

- Phone : +1.747.992.5440

- Company : Dickinson Group

- Job : Library Worker

- Bio : Recusandae enim nam aliquid sint aut fugit aut. Odio ad hic qui et voluptate atque. Quae eligendi quis nihil odio. Amet et necessitatibus quis autem iusto consectetur.

Socials

facebook:

- url : https://facebook.com/armando_breitenberg

- username : armando_breitenberg

- bio : Explicabo impedit magni excepturi iure dolores. Totam et illo odit.

- followers : 3774

- following : 1876

twitter:

- url : https://twitter.com/armando_id

- username : armando_id

- bio : Qui laudantium qui reiciendis consequuntur. Similique commodi asperiores consequatur. Corrupti cumque quos non ut excepturi magni.

- followers : 641

- following : 1551

tiktok:

- url : https://tiktok.com/@armando_breitenberg

- username : armando_breitenberg

- bio : Ea impedit impedit recusandae nostrum iure voluptatem.

- followers : 3820

- following : 2099

instagram:

- url : https://instagram.com/breitenberg1989

- username : breitenberg1989

- bio : Nihil qui exercitationem ratione. Earum rerum necessitatibus vitae eligendi vero rerum porro.

- followers : 2133

- following : 1202

linkedin:

- url : https://linkedin.com/in/armandobreitenberg

- username : armandobreitenberg

- bio : Dolore ipsum explicabo iste sapiente sequi qui.

- followers : 3226

- following : 1087